RBI Bids Farewell to 2000 Rupee Notes, Unleashing a Transformative Financial Paradigm!-IAS BANENGE

RBI Imposes Ban on Rs 2000 Note Circulation: The Reserve Bank of India (RBI) has recently announced its decision to discontinue the issuance of new two thousand rupee notes. However, existing notes can be exchanged at banks between 23rd May and 30th September.

RBI Halts Circulation of Rs 2000 Notes, Implements ATM and Rural Exchange Measures

In a significant move, the Reserve Bank of India (RBI) has advised banks to discontinue the issuance of Rs 2000 denomination notes. The central bank has taken this decision to reshape the currency landscape and promote efficient cash management. In a letter addressed to banks, the RBI has instructed them to reconfigure ATMs and recycling machines to ensure that two thousand rupee notes are no longer dispensed to the public during ATM withdrawals or cash transactions.

The directive aims to gradually phase out the circulation of Rs 2000 notes and encourage the use of lower denominations, thereby facilitating ease of transactions and reducing the likelihood of hoarding high-value currency. By recalibrating ATMs and recycling machines, banks can effectively align their cash disbursal systems with the new guidelines.

To address concerns in rural and remote areas where banking infrastructure may be limited, the RBI has also directed banks to provide assistance in exchanging notes through the use of mobile vans. These vans will act as mobile banking units, reaching out to communities that lack access to physical banking facilities. This initiative ensures that individuals residing in underserved regions can easily exchange their Rs 2000 notes with lower denomination currency.

The decision to halt the circulation of Rs 2000 notes marks a strategic shift in the RBI’s currency management strategy. By discontinuing the issuance of these high-value notes, the central bank aims to curb black money transactions, promote transparency, and enhance the effectiveness of anti-money laundering efforts. It also aims to encourage the adoption of digital payment methods, further supporting the government’s vision of a cashless economy.

The reconfiguration of ATMs and recycling machines is a crucial step in aligning the cash infrastructure with the new directive. Banks will need to ensure that the machines are updated to dispense a mix of lower denomination notes, making it easier for individuals to carry out day-to-day transactions. This move is expected to reduce the dependency on high-value notes and encourage the use of smaller denominations, promoting financial inclusivity and ease of trade.

Furthermore, the provision of mobile vans for note exchange in remote areas highlights the RBI’s commitment to providing banking services to all sections of society. These vans will act as a bridge between the rural population and formal banking channels, facilitating the exchange of Rs 2000 notes with lower denominations. By bringing banking services to the doorsteps of underserved communities, the RBI aims to mitigate the inconvenience caused by the discontinuation of high-value notes in regions with limited access to banking facilities.

The RBI’s decision to withdraw Rs 2000 notes and implement measures to ensure their replacement reflects a comprehensive approach to currency management. The move is aligned with the government’s broader agenda of promoting financial transparency, reducing black money circulation, and encouraging the adoption of digital payment systems. By reconfiguring ATMs, recycling machines, and deploying mobile vans, the RBI aims to smoothen the transition process and minimize any disruption faced by the public during the currency exchange process.

“HOW MUCH CURRENCY YOU CAN EXCHANGE?”

“RBI Implements Limit: Up to Rs 20,000 of Rs 2000 Notes Allowed for Simultaneous Exchange, Deposits Discontinued after September 30”

Starting May 23, 2023, the Reserve Bank of India (RBI) has introduced a maximum exchange limit of Rs 20,000 for Rs 2000 denomination notes. This decision aims to ensure that the normal functioning of banks is not disrupted while facilitating the exchange process for individuals. However, after September 30, 2023, banks will no longer accept deposits of Rs 2000 notes. It is important to note that these notes will continue to be legal tender, but depositors may be required to provide an explanation as to why they have not deposited these notes earlier.

The RBI’s move to set a limit on simultaneous exchanges is aimed at managing the workload of banks and minimizing any potential disruptions to their operations. By allowing individuals to exchange up to Rs 20,000 worth of Rs 2000 notes at a time, the RBI aims to strike a balance between facilitating the currency transition process and ensuring the smooth functioning of banking services.

However, it is crucial to be aware that after September 30, 2023, banks will no longer accept deposits of Rs 2000 notes. This indicates that individuals will need to ensure that they have exchanged or utilized these notes by the specified deadline. The RBI’s decision to discontinue accepting deposits of Rs 2000 notes reflects the central bank’s efforts to gradually phase out these high-value notes and promote the circulation of lower denomination currency.

While Rs 2000 notes will retain their legal tender status, depositors who choose to deposit them after September 30 may be required to provide an explanation for the delay in depositing these notes. This measure serves as a means of monitoring and tracking the circulation of high-value currency.

“RBI’s Directive to Banks: Cease Transactions with Rs 2000 Notes, Focus on Lower Denominations”

“RBI Directs Banks: Cease Issuance of Rs 2000 Notes, Reconfigure ATMs, and Introduce Mobile Vans for Rural Exchanges”

The Reserve Bank of India (RBI) has issued an advisory to banks, instructing them to discontinue the issuance of Rs 2000 denomination notes. In a written directive, the RBI has ordered banks to reconfigure their ATMs and recycling machines, ensuring that these machines no longer dispense two thousand rupee notes to the general public during cash withdrawals. This move aims to promote the use of lower denomination currency and facilitate smoother transactions.

Furthermore, the RBI has also directed banks to assist individuals in rural and remote areas, where banking services may be limited or unavailable. Banks have been instructed to employ mobile vans as a means to help people exchange their Rs 2000 notes, particularly in regions without easy access to physical banking facilities. This initiative intends to ensure that individuals residing in underserved areas can conveniently exchange their high-value notes for lower denomination currency.

Overall, the RBI’s advisory mandates banks to halt the issuance of Rs 2000 notes and take necessary steps to reconfigure ATMs and recycling machines accordingly. Additionally, banks are urged to provide support in rural areas through the deployment of mobile vans, enabling smoother currency exchanges for those in need. These measures align with the RBI’s objective of promoting efficient cash management and financial accessibility across the country.

RAED MORE- Pakistan’s Political Crisis’s Impact on India |Ias Banenge

“Printing Halted: RBI Ceases Production of Rs 2000 Notes”

“RBI Ends Rs 2000 Note Production: Sufficient Stock of Lower Denomination Notes Meets Transactional Demand”

In a recent press release, the Reserve Bank of India (RBI) acknowledged that the two thousand rupee note has not been extensively utilized in transactions. The RBI further stated that an ample supply of 100, 200, and 500 rupee notes is available to fulfill the cash requirements of the public. The introduction of the Rs 2000 note was considered fulfilled after achieving sufficient quantities of lower denomination notes.

The RBI’s decision to discontinue printing Rs 2000 notes dates back to the fiscal year 2018-19. The central bank recognized the limited usage of these high-value notes in day-to-day transactions and found that the presence of an adequate quantity of 100, 200, and 500 rupee notes adequately catered to the public’s cash needs.

With a focus on optimizing the cash supply in circulation, the RBI’s move to halt the production of Rs 2000 notes aligns with the objective of maintaining an appropriate mix of currency denominations. By prioritizing the availability of lower denomination notes, the RBI aims to support the efficient functioning of the economy and ensure that the transactional demands of the public are adequately met.

In summary, the RBI has ceased the printing of Rs 2000 notes, citing their limited utilization in transactions. The central bank emphasized the ample stock of lower denomination notes, including 100, 200, and 500 rupee denominations, which effectively fulfills the cash requirements of the public. By halting the production of Rs 2000 notes and focusing on maintaining an appropriate mix of currency denominations, the RBI aims to optimize cash supply and facilitate smoother transactions.

“Evolution of the Rs 2000 Currency Note: A Brief Journey through its Creation and Transition”

The introduction of the Rs 2000 currency note marked a significant milestone in India’s currency landscape. Let’s explore the evolution of the Rs 2000 note, from its inception to the subsequent changes in its circulation and usage.

Inception and Purpose: The Reserve Bank of India (RBI) introduced the Rs 2000 note as part of its efforts to address the high-value denomination needs in the aftermath of demonetization in 2016. The note was intended to facilitate large-value transactions while streamlining the currency system.

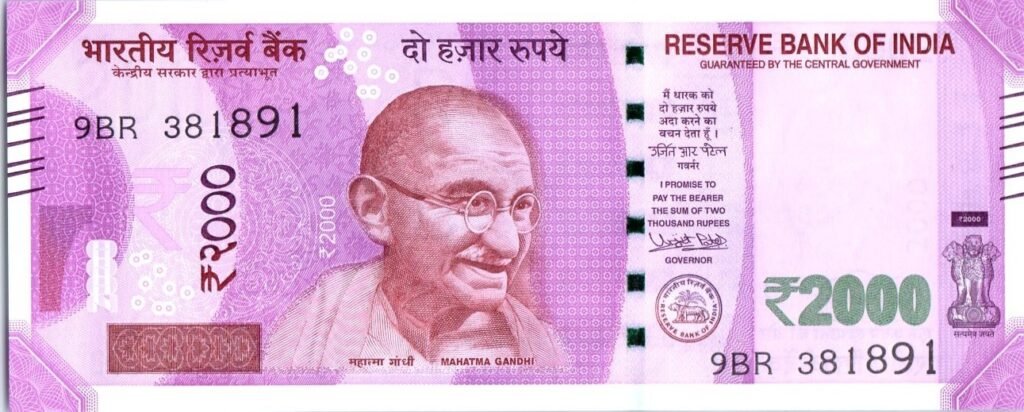

Features and Design: The Rs 2000 note showcased distinct security features and an aesthetically appealing design. It featured prominent elements such as Mahatma Gandhi’s portrait, the Mangalyaan emblem representing India’s space exploration, and the motif of the Mars Orbiter Mission.

Initial Circulation and Acceptance: Following its launch, the Rs 2000 note entered circulation, coexisting with other denominations. While its larger value provided convenience for transactions involving significant amounts, its acceptance and utilization in everyday transactions varied across different sectors and regions.

Reduced Usage and Printing Halt: Over time, it became apparent that the Rs 2000 note was not widely used in routine transactions. Recognizing this trend, the RBI gradually reduced its printing and subsequently ceased the production of new Rs 2000 notes in the fiscal year 2018-19. The decision aimed to rationalize the currency mix and address the evolving cash requirements of the public.

Transition to Lower Denomination Notes: As the RBI discontinued printing Rs 2000 notes, greater emphasis was placed on ensuring sufficient availability of lower denomination notes, such as Rs 100, Rs 200, and Rs 500. This strategic shift aimed to enhance the efficiency of daily transactions and align with the evolving cash management strategies.

Currency Evolution and Adaptation: The evolution of the Rs 2000 note reflects the dynamic nature of India’s currency system. The focus on promoting digital transactions, the emergence of alternative payment methods, and the prevalence of lower denomination notes contributed to the reduced prominence of the Rs 2000 note in everyday transactions.

DEMONETISATION IN INDIA

In November 2016, the Government of India announced the demonetization of the ₹500 and ₹1,000 banknotes as part of an effort to combat the shadow economy, counterfeit currency, and illegal activities. The move aimed to encourage cashless transactions and reduce the use of illicit funds for terrorism and illegal activities. However, the demonetization process resulted in prolonged cash shortages and disruptions across the economy.

Citizens faced difficulties in exchanging their banknotes, leading to long queues and some unfortunate deaths. Despite the initial goals, the majority of the demonetized banknotes were eventually deposited in banks, indicating that the effort did not succeed in removing black money from the economy.

The announcement had significant economic repercussions, with the stock market experiencing a sharp decline and the country’s industrial production and GDP growth rate being negatively affected. The move resulted in the loss of an estimated 1.5 million jobs. On the positive side, there was an increase in digital and cashless transactions throughout the country.

While the demonetization decision initially received support from some central bankers and international commentators, it also faced criticism for its poor planning and perceived unfairness. Protests, litigation, and strikes against the government took place in various parts of India. The move sparked debates in Parliament, where the merits and drawbacks of the decision were discussed.

In summary, the demonetization of ₹500 and ₹1,000 banknotes in 2016 aimed to tackle illicit activities and promote cashless transactions. However, it led to cash shortages, economic disruptions, and job losses. The majority of the demonetized currency was eventually deposited in banks, raising questions about the effectiveness of the measure in eliminating black money. The move also sparked both support and criticism, leading to protests, litigation, and debates in Parliament.

BACKGROUND OF DEMONETISATION

The Indian government had previously demonetized banknotes in 1946 and 1978 to combat tax evasion and tackle the issue of “black money” held outside the formal economic system. In 1978, the Janata Party coalition government demonetized banknotes of ₹1,000, ₹5,000, and ₹10,000 to address concerns regarding counterfeit money and black money.

However, in 2012, the Central Board of Direct Taxes advised against demonetization, stating that it might not effectively address the issue of black money. A report highlighted that benami properties, bullion, and jewelry were the primary forms of black money holdings, rather than cash. Income tax probes indicated that black money holders kept only a small portion, around 6% or less, of their wealth in the form of cash. This data suggested that targeting cash alone would not be a successful strategy in combating black money.

Overall, while the Indian government had previously used demonetization as a means to tackle tax evasion and black money, in 2012, expert recommendations highlighted the limitations of solely targeting cash in addressing the issue effectively.

Pingback: GAGAN Satellite Technology |Ias Banenge - Ias Banenge